Understanding Financial Infidelity

Financial infidelity refers to the act of concealing financial transactions, assets, or obligations from a partner in a committed relationship.

Unlike emotional or physical cheating, which typically involves romantic or sexual attraction to someone outside the primary relationship, financial infidelity is centered around dishonesty regarding monetary matters. It’s a form of betrayal that can be equally damaging, leading to a breakdown of trust and a sense of insecurity between partners.

Individuals might engage in financial infidelity for various reasons. One common motive is the desire to maintain secrets from one’s partner, often stemming from feelings of guilt or fear regarding their spending habits.

Such secrets can include hidden bank accounts, unpaid debts, or extravagant purchases that their partner is unaware of. In some cases, individuals may view their financial decisions as personal and separate from the relationship, believing they have the right to spend without accountability.

Another reason for financial infidelity can be external financial obligations. This occurs when individuals have financial commitments or debts related to a previous relationship or family obligations, such as child support or alimony, that they feel unable to disclose. These commitments can create a strain in the current relationship, as secrets regarding finances may culminate in feelings of betrayal and mistrust if discovered.

The emotional impact of financial infidelity on the betrayed partner can be profound. Feelings of anger, confusion, and betrayal can arise upon learning about hidden financial activities. This type of deception can complicate the emotional landscape of the relationship, making recovery more challenging.

The partner who has been deceived may question not only their trust in their partner but also their own judgment, potentially leading to long-term repercussions that extend far beyond financial concerns.

Common Financial Signs of Cheating

When examining the financial behaviors of a partner, certain activities can raise red flags that may indicate infidelity. Understanding these signs can provide insights into the trust and transparency within a relationship. Here are several specific financial behaviors that might suggest a partner is cheating:

Firstly, unexplained expenses are one of the most significant red flags. If your partner is making purchases or incurring costs that do not seem to correlate with their spending habits, this could warrant further investigation.

For instance, if you suddenly discover charges for restaurants that neither you nor your partner frequented or unexpected transactions on credit card statements, it is important to seek clarity. These unexplained expenses might suggest that your partner is engaging in activities that they do not want to share with you.

Another indicator is an increase in spending in particular categories. If you notice that your partner is spending more money on clothing, gifts, fine dining, or entertainment without a corresponding income increase, this could signal a problem. For example, excessive spending on gifts could imply that they are trying to impress someone else.

Additionally, if their social media shows a lifestyle that is inconsistent with their financial disclosures, it may be worth discussing such discrepancies.

Changes in billing patterns are also noteworthy. If your partner begins to receive mail at unusual hours, utilizes a different phone plan, or opts for cash transactions more frequently, these may indicate that they are trying to conceal certain activities. Such behaviors create a lack of transparency, which can harm the foundation of trust within a relationship.

Recognizing these financial signs of cheating can be critical in identifying potential issues. While these indicators don’t provide conclusive proof of infidelity, they serve as important cues for initiating open and honest discussions about financial habits and relationship dynamics.

Changes in Spending Patterns

One of the most telling signs of potential infidelity can be found in a partner’s spending habits. Unusual changes in these patterns may serve as red flags, warranting careful observation. A noticeable increase in cash withdrawals can be particularly concerning.

If a partner who typically uses credit or debit cards suddenly begins to withdraw larger sums of cash frequently, it may suggest they are trying to conceal their spending, which could indicate deceitful behavior. Cash transactions lack the traceability of electronic ones, making them a preferred method for those wishing to hide expenditures.

Additionally, pay attention to mysterious purchases that seem out of character for your partner. This could include items that are not purchased for shared experiences or things that appear to be personal and unaccounted for. If your partner has recently made large purchases or frequent smaller ones that do not fit within your joint lifestyle, it may raise questions about where these expenses are going.

A sudden onset of subscriptions or memberships that you are unaware of can also be a signal; if your partner has signed up for services that they do not share or discuss with you, this could suggest a desire to keep certain activities hidden.

It’s neccessary to approach this topic with caution, as not all changes in spending habits indicate cheating. Factors such as personal interests, lifestyle changes, or even financial stress can lead to alterations in how someone manages their finances.

However, by maintaining an open line of communication and discussing any noticeable shifts, you can foster transparency in your relationship. Watching for these subtle yet significant signs can be fundamental in identifying potential issues before they escalate.

Online and Virtual Romance Indicators

The emergence of online and virtual relationships has transformed the landscape of romance, introducing new financial indicators that may suggest infidelity. As digital platforms increasingly facilitate dating, understanding the financial signs associated with these virtual engagements becomes crucial. One primary consideration is the expenditure on virtual dates.

Many individuals engage in online activities such as video calls, which may lead to spending on snacks, beverages, and possibly even gifts delivered to their partner’s address. Monitoring sudden or recurrent purchases related to virtual dating can serve as a significant red flag.

In addition to expenditures tied to online dates, the acquisition of virtual gifts and subscriptions is worth noting. With the widespread use of dating applications and platforms offering premium features, a partner’s subscription to a dating app raises questions, especially if it’s not disclosed.

If members of a couple find that their partner is investing in services specifically aimed at enhancing romantic connections with others, it may indicate a breach of relationship trust. Furthermore, gifting virtual items in online gaming or social media platforms can also divert significant amounts of money, suggesting a secretive relationship.

Another important aspect is the potential presence of hidden accounts. If a partner exhibits unusual behavior such as not sharing their financial details or disallowing access to bank statements, it could be indicative of an attempt to obscure dishonest spending.

Instances of small, unexplained charges on credit cards or banking transactions redirecting to unknown platforms are often symptoms of hidden activities. Keeping an eye on these financial signs can provide insights into the authenticity of your partner’s online behavior. By maintaining open communication and vigilance regarding these elements, individuals can better gauge whether their partner’s online activities align with transparent intentions.

The Role of Technology in Financial Deceit

In an increasingly digital world, technology plays a significant role in financial deceit, making it easier for individuals to conceal their spending habits. Mobile payment services, such as Venmo, Cash App, and PayPal, offer convenience in transactions, but they also present opportunities for financial infidelity.

These platforms enable users to transfer money quickly and anonymously, often without a paper trail that can be scrutinized by partners. As a result, it becomes challenging to monitor where funds are being allocated.

Furthermore, cryptocurrency technology has revolutionized how money is exchanged and makes concealing financial activities even more accessible. With the ability to conduct transactions that bypass traditional banking systems, cryptocurrencies like Bitcoin offer enhanced privacy features.

This anonymity can facilitate hidden expenses or secret investments that may not be readily apparent in a partner’s financial behavior. Consequently, the rise of these digital currencies has increased the difficulty of monitoring a partner’s financial commitment.

Another method of financial concealment involves the use of hidden accounts across various platforms. Some individuals may establish secret bank accounts or credit cards that are unassociated with shared financial responsibilities, allowing them to engage in discretionary spending without detection.

This lack of transparency can lead to significant trust issues when one partner is unaware of the other’s financial obligations or expenditures.

To detect potential signs of financial deceit facilitated by technology, individuals should maintain open communication with their partners regarding financial habits and encourage transparency around digital transactions.

Monitoring shared financial accounts and scrutinizing unusual withdrawals or deposits may also be effective. By addressing the potential for digital secrecy early on, partners can foster a more trustworthy financial environment that discourages deceitful behavior.

Emotional and Behavioral Signs of Cheating

While financial signs of cheating can serve as a pivotal indicator of infidelity, it is essential to recognize that emotional and behavioral changes in a partner may also provide significant clues. These manifestations usually correlate with the core issue of distrust and deception. One common indicator is a noticeable change in communication patterns.

If your partner has suddenly become less transparent about their day-to-day activities or shows reluctance to discuss financial matters, it may warrant closer scrutiny. A decrease in open dialogue can signal an underlying secrecy that often accompanies infidelity.

Additionally, a notable reduction in intimacy can be a strong behavioral sign of cheating. This reduction may not only apply to physical intimacy but can also extend to emotional closeness.

If you find that your partner is frequently distant or disengaged, it might indicate a shift in their emotional investment in the relationship. Such changes could stem from feelings of guilt or a lack of commitment, often correlated with financial infidelity.

Increased defensiveness about spending habits can also serve as a red flag. As couples combine their finances, any monetary discrepancies should ideally be approached with candor. If your partner reacts with hostility or evasion when queries arise regarding their expenditures, this defensiveness may be more than a simple desire for privacy. It often reflects a conscious effort to conceal potential indiscretions.

Understanding the emotional and behavioral signs of cheating can assist in identifying potential financial infidelity as well. By being aware of these indicators, partners can more effectively communicate and address grievances that may otherwise go unnoticed.

Ultimately, recognizing emotional signals is crucial to fostering trust and ensuring a healthy relationship.

How to Confront Your Partner

Addressing the issue of financial infidelity with your partner can be a daunting task, requiring careful consideration and a thoughtful approach. The first step is to choose an appropriate time and setting for the conversation.

Opt for a moment free from distractions, ensuring both parties are calm and open to discussion. Avoid initiating this critical dialogue during moments of high stress or anger, as emotions may hinder effective communication.

It is crucial to approach the subject gently and without accusation. Start the conversation by expressing your concerns about spending habits in a non-confrontational manner. For instance, you might say, “I noticed some recent transactions that raised my concern, and I would like to discuss them with you.” This approach enables a more collaborative atmosphere, allowing for a dialogue rather than a confrontation.

Utilizing “I” statements can also be beneficial. Phrasing your observations and feelings in a way that reflects your perspective encourages your partner to listen openly. For example, you could phrase it as, “I feel worried when I see spending that seems inconsistent with our financial goals.” This not only conveys your feelings but also invites your partner to share their point of view without feeling attacked.

While addressing potential red flags in financial habits, consider the emotional implications both you and your partner may experience. Acknowledge that this conversation can be difficult for both sides and allow space for your partner to express their feelings.

Be prepared for various reactions; they may feel defensive, guilty, or even surprised, depending on the situation. Active listening and empathy are key during this discussion to facilitate an effective exchange of perspectives.

Ultimately, clarity and understanding are paramount. Aim to reach a common ground regarding financial transparency and trust. Establishing shared financial goals can rejuvenate your partnership and lay the groundwork for open communication in the future.

Protecting Your Financial Assets

In the realm of personal relationships, financial infidelity can be a troubling issue that jeopardizes not only one’s emotional well-being but also financial stability. To safeguard against potential misuse of money and assets, individuals must adopt proactive measures that ensure transparency and protection of their financial interests.

One effective strategy is to consider separating bank accounts. By maintaining individual accounts alongside joint ones, partners can have clearer insights into where their money is being allocated, which can reduce the risks associated with financial mismanagement.

Furthermore, setting up alerts for unusual transactions can significantly enhance one’s ability to monitor financial activities. Many banks and financial institutions offer services that allow account holders to receive notifications for specific transactions, such as large withdrawals or purchases.

Implementing these alerts can provide early warning signs of potentially unauthorized or unanticipated spending behaviors, granting individuals an opportunity to investigate and address any irregularities promptly.

Seeking legal advice is another prudent step individuals can take to protect their financial assets. Consulting with a financial advisor or a legal professional specializing in family law can equip individuals with the knowledge necessary to navigate financial agreements, especially in the event of a separation or divorce.

Legal counsel can provide insight into asset protection strategies, such as prenuptial or postnuptial agreements, which explicitly outline the distribution of financial resources should the relationship falter. These agreements serve as a buffer against unilateral financial decisions that could otherwise jeopardize one partner’s financial security.

Ultimately, being vigilant and proactive in managing financial assets is essential for maintaining financial integrity within any partnership. By implementing these protective measures, individuals can create an environment of financial transparency and accountability that benefits both partners and enhances relationship trust.

Steps to Take if Cheating is Confirmed

Discovering financial infidelity in a relationship can be devastating, leaving individuals feeling betrayed and uncertain about their future. Once evidence of cheating is confirmed, it’s best to take a structured approach to address the situation and minimize further damage. The first step is to assess the extent of the financial infidelity.

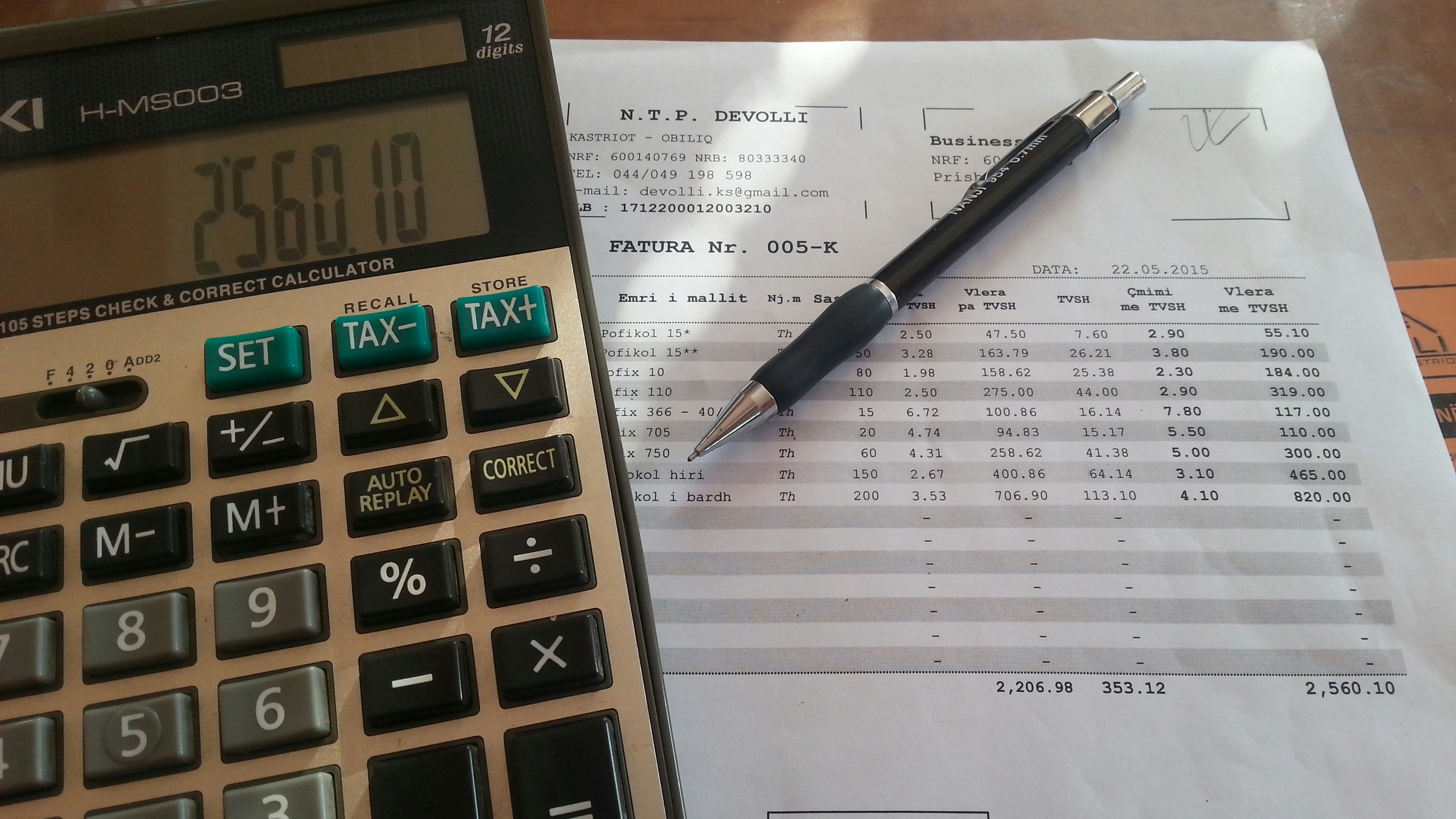

Gather all relevant financial documents, including bank statements, credit card bills, and any other records that reveal your partner’s spending habits. This comprehensive overview will help you understand the financial implications of their actions and provide a clear picture of any potential losses.

After assessing the damage, it is crucial to reevaluate your financial plans. Consider how your partner’s spending may have affected shared assets, debts, or future financial goals.

This reevaluation should include a review of your joint or individual budgets, savings plans, and investments. It may be necessary to adjust these plans based on the new circumstances to ensure your financial stability moving forward.

At this point, it may also be beneficial to seek professional guidance. Couples facing financial infidelity often consider counseling to facilitate open communication and address underlying issues in the relationship. A licensed therapist can help both partners explore the reasons behind the financial betrayal and develop strategies to rebuild trust.

In some cases, legal guidance may be warranted to protect your financial interests, particularly if shared assets or liabilities are involved. Consulting a financial advisor or attorney can provide insights into how to proceed legally and financially while ensuring that you are supported during this challenging time.

Overall, responding thoughtfully and strategically to confirmed financial infidelity can help individuals regain control over their financial future and ultimately make informed decisions moving forward.